ScoreEasy - AI-Powered Credit Scoring & Risk Intelligence

ScoreEasy - AI-Powered Credit Scoring & Risk Intelligence

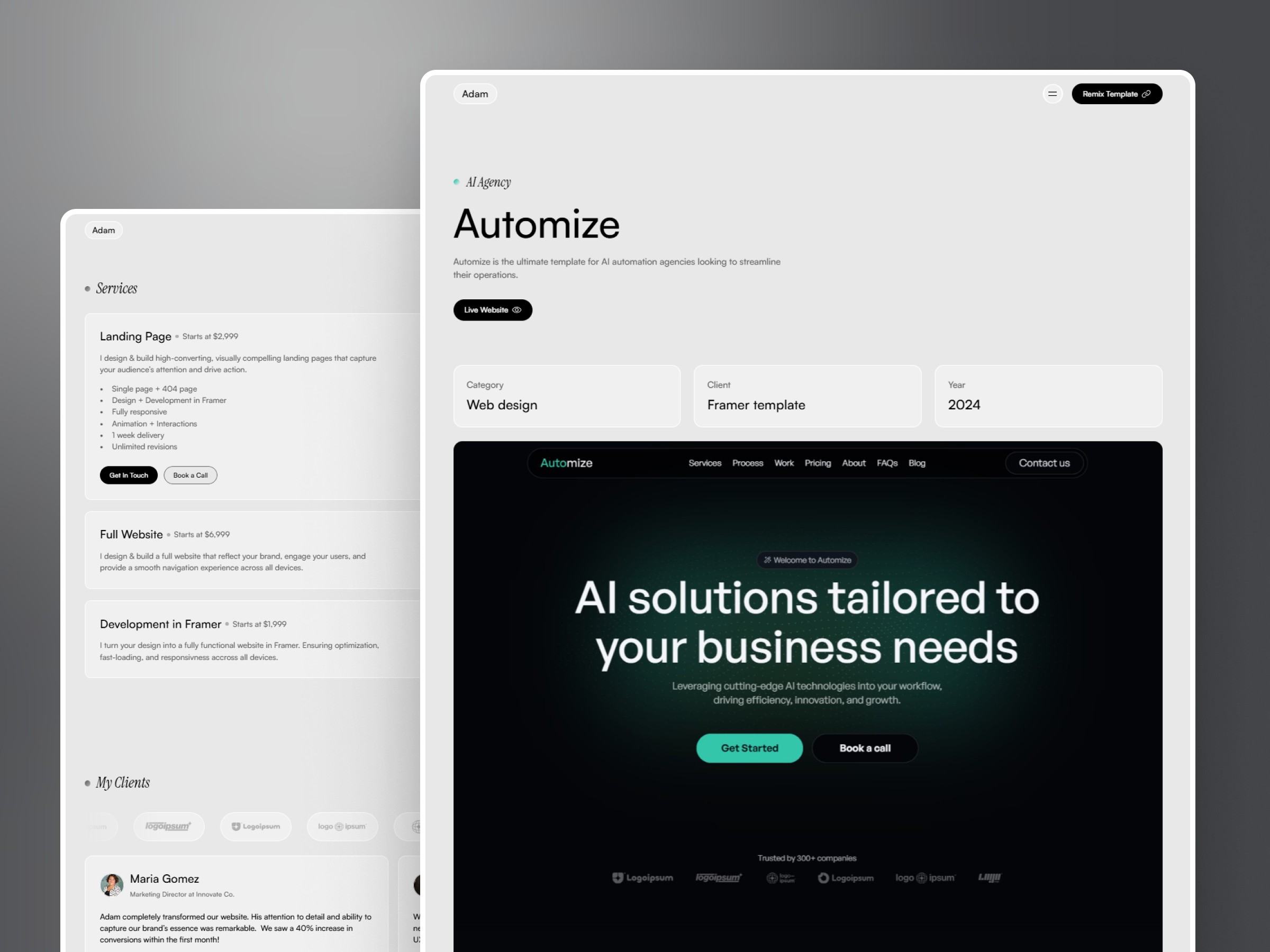

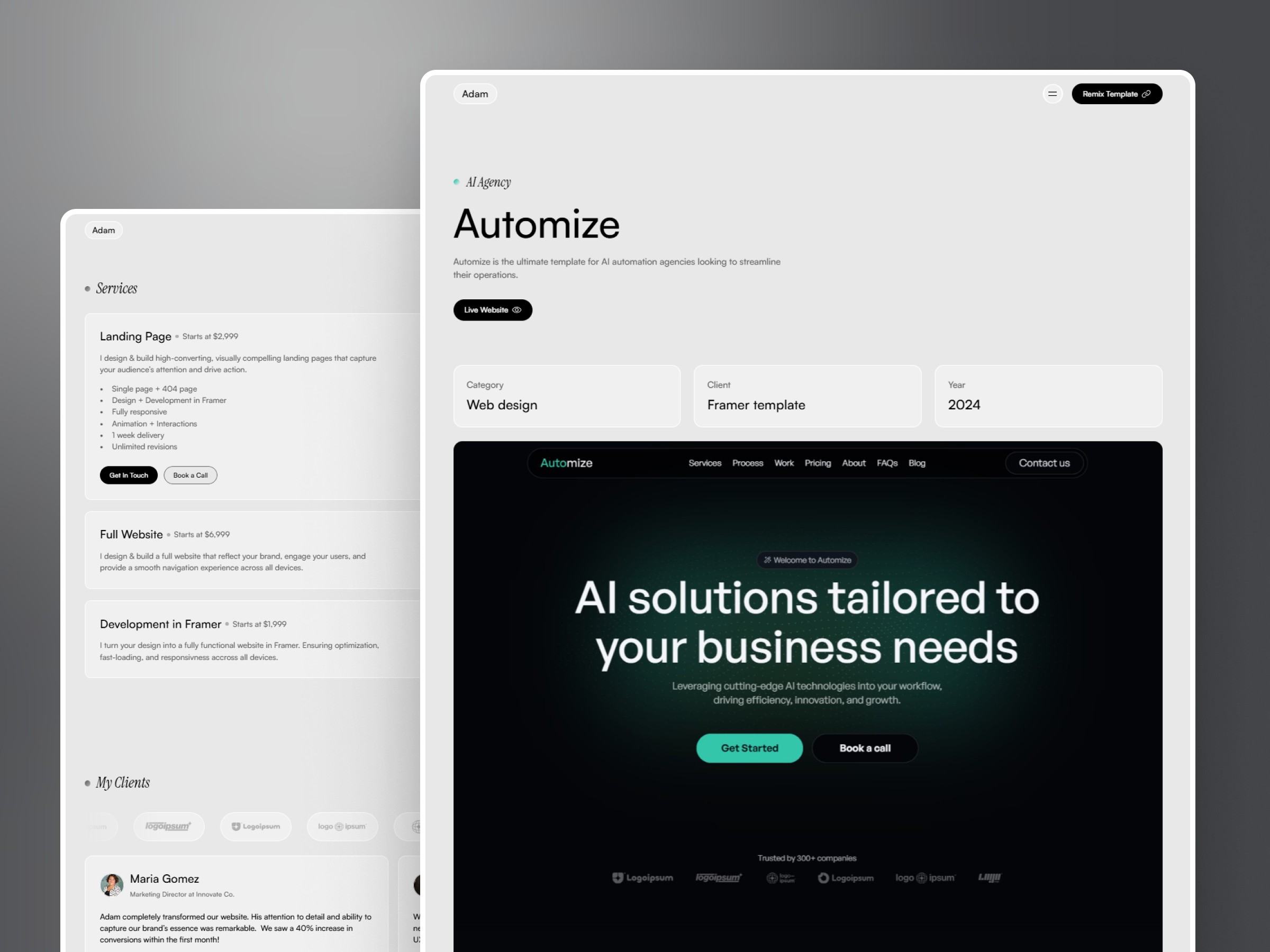

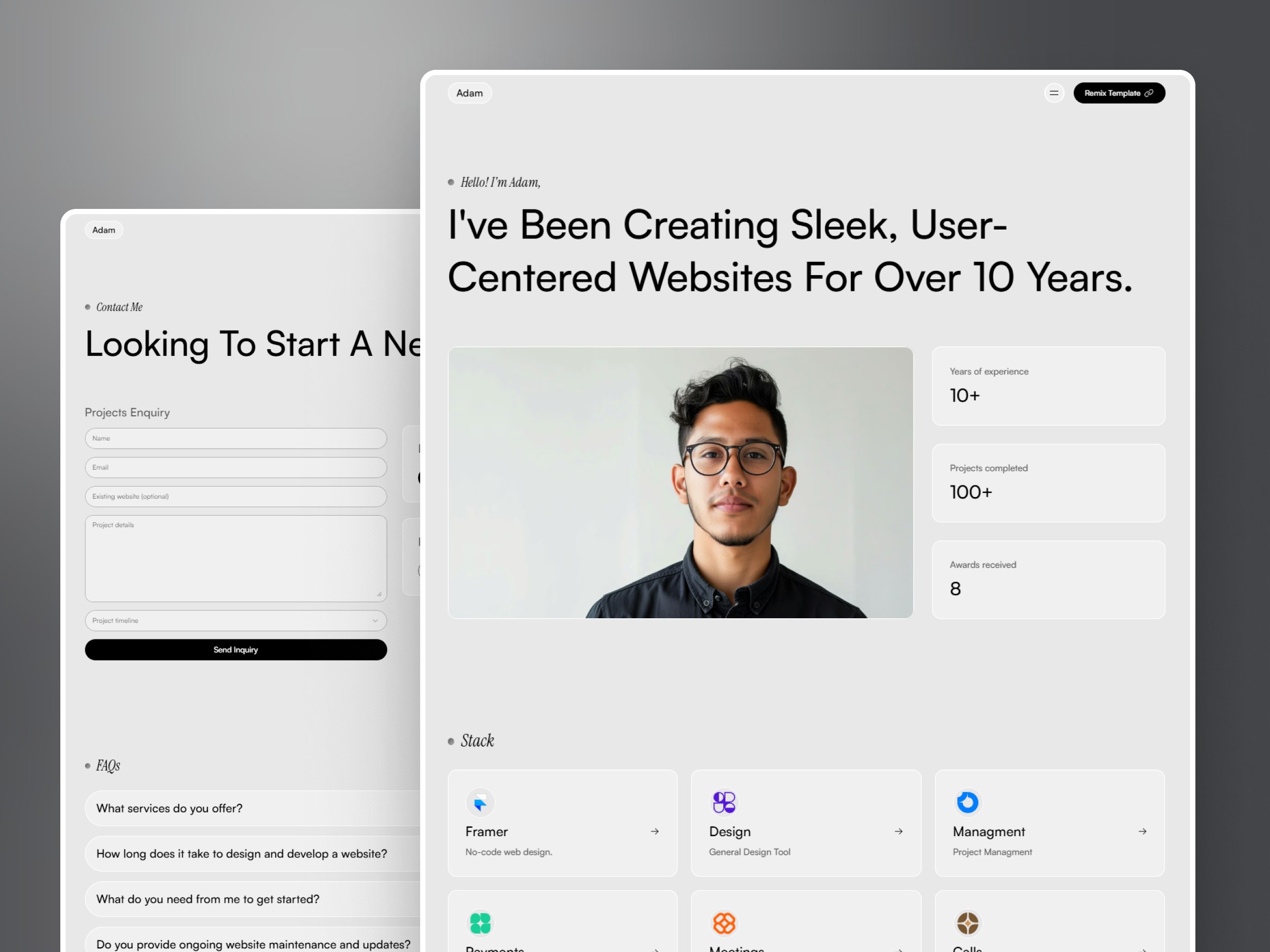

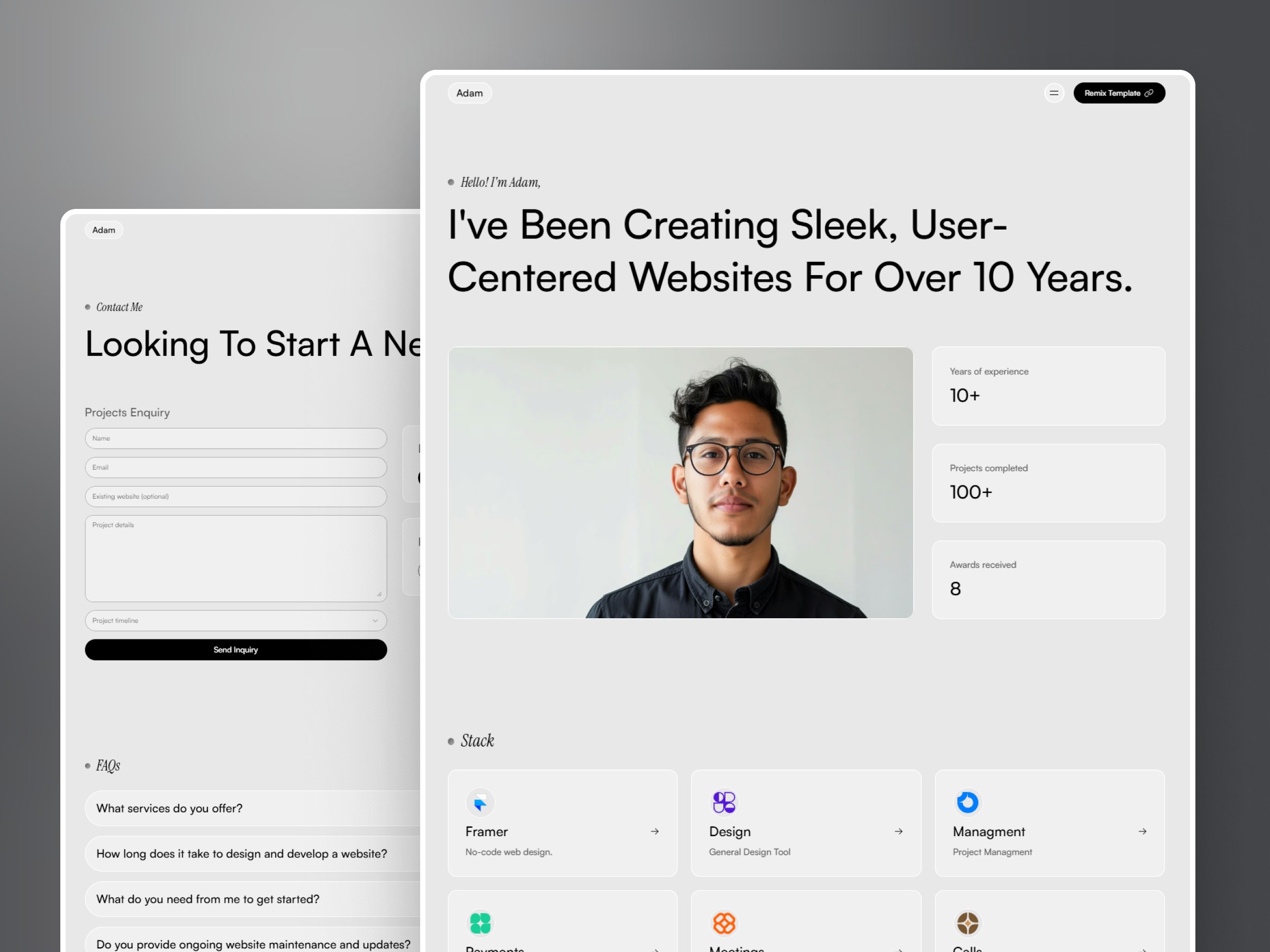

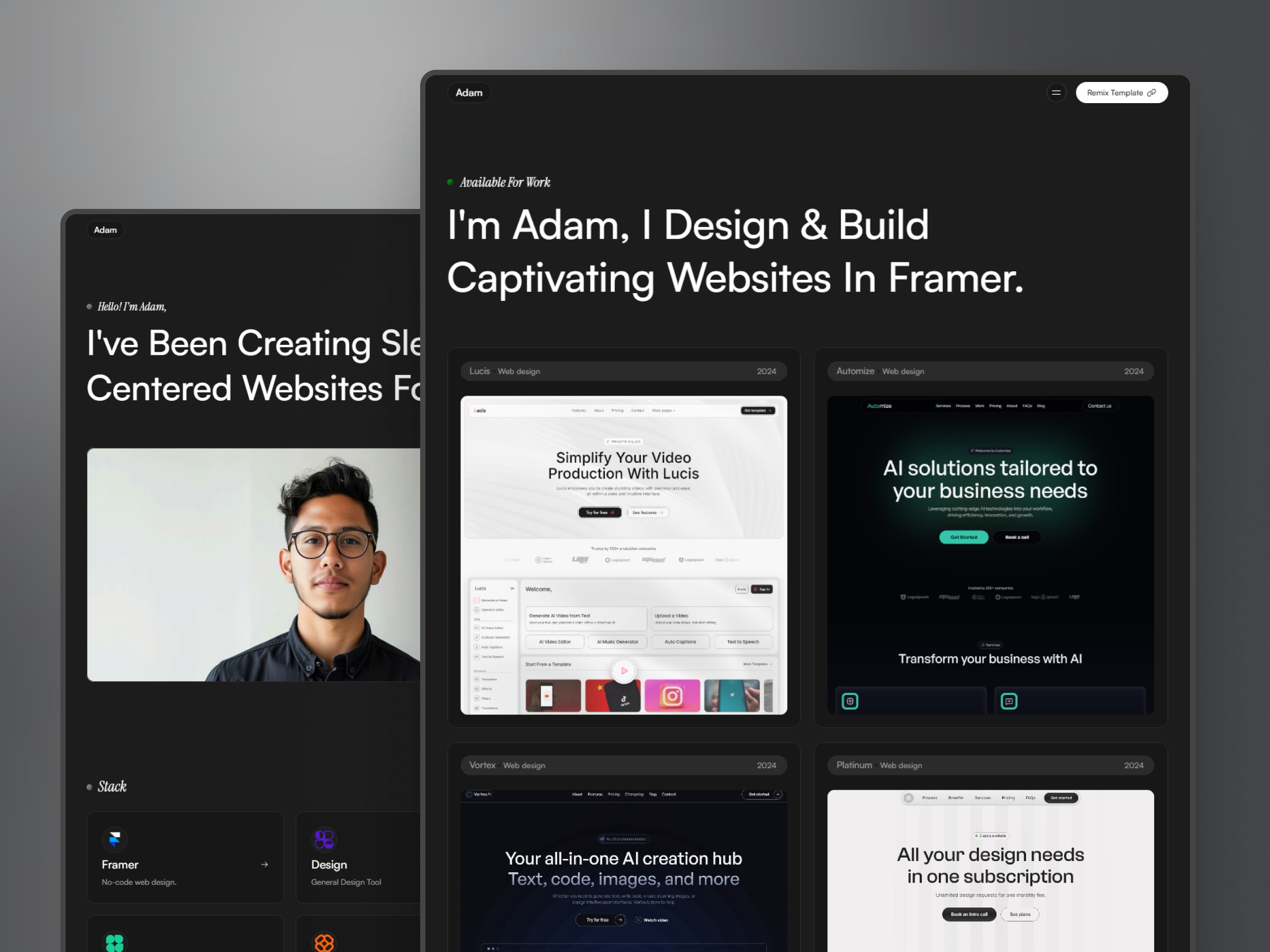

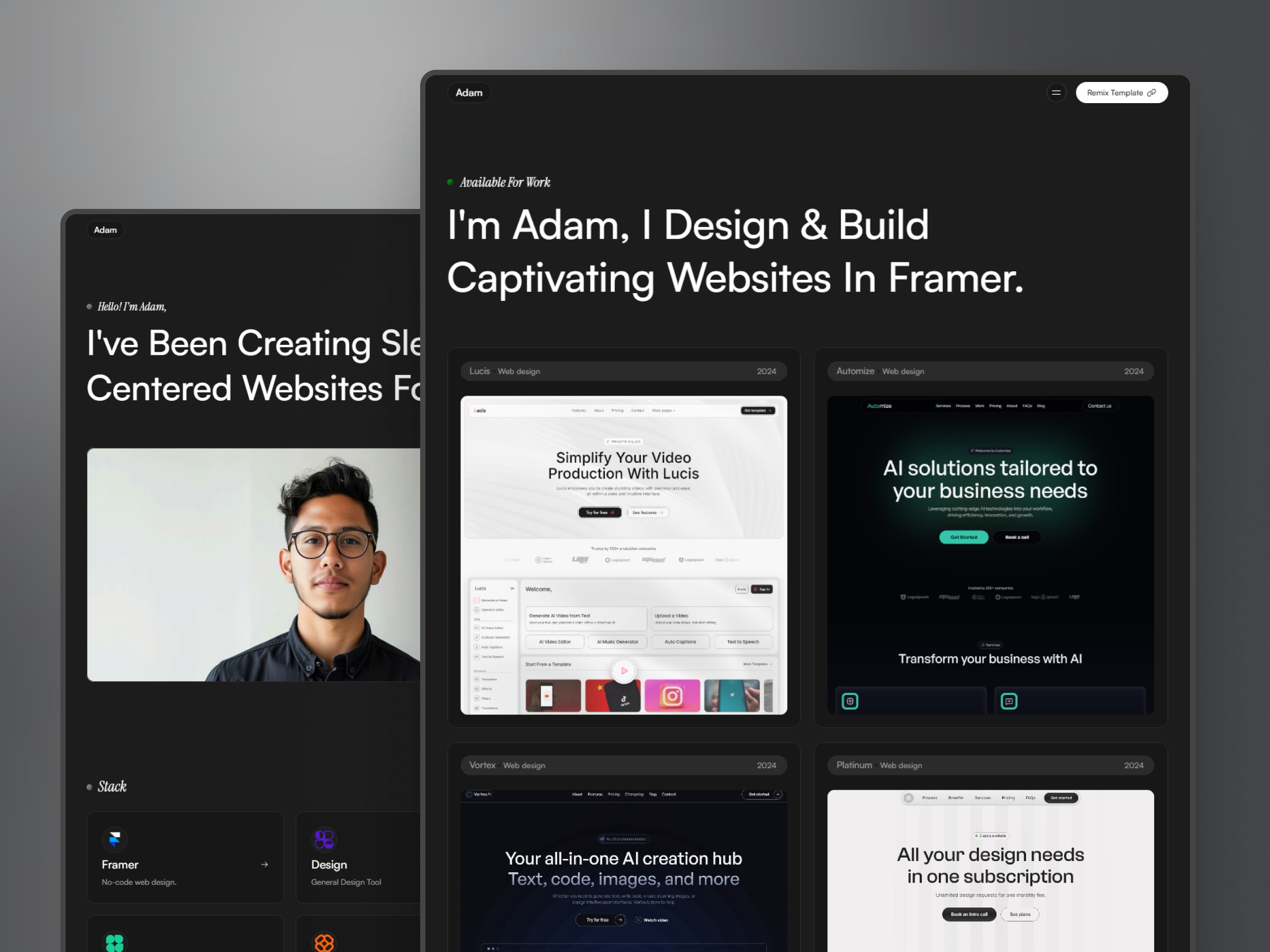

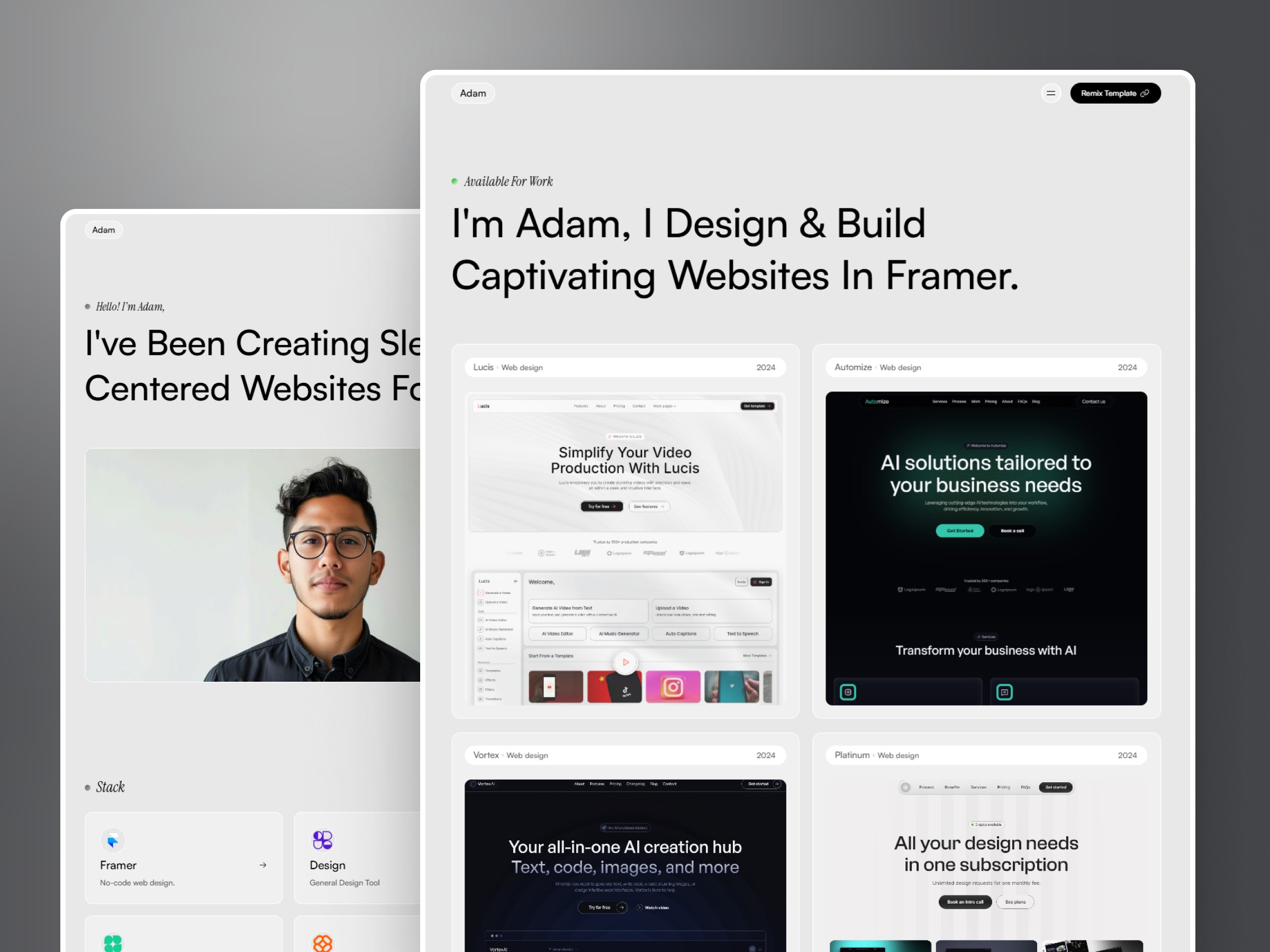

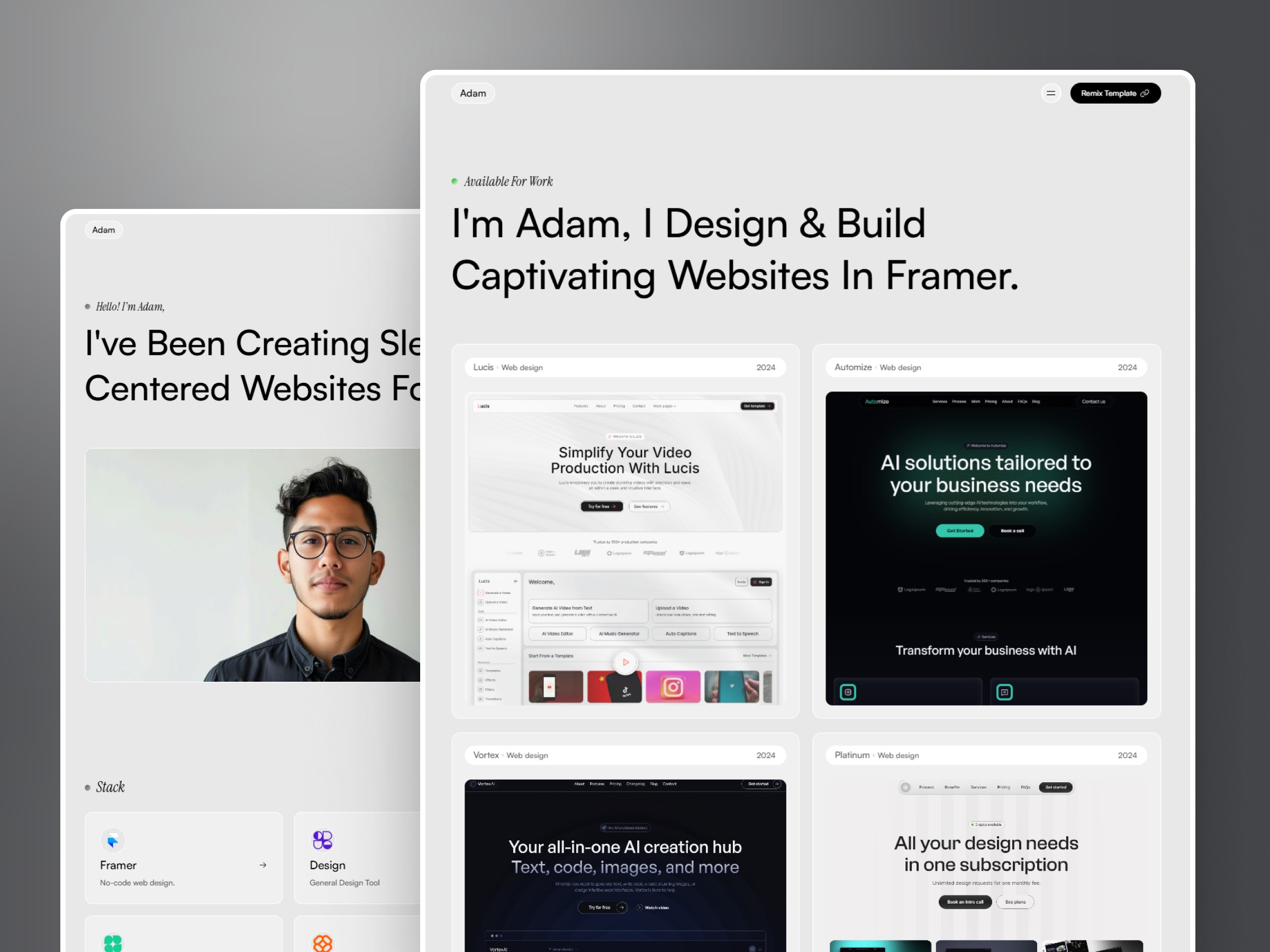

ScoreEasy simplifies credit decisioning by transforming complex financial data into clear, actionable insights. The platform automates risk assessment, ensuring fair, accurate, and bias-mitigated credit scoring, making lending more inclusive and efficient. With an intuitive dashboard, API-ready integration, and real-time analytics, ScoreEasy streamlines financial operations—reducing processing time, improving loan approvals, and minimizing default risks. Built with compliance and transparency in mind, it helps financial institutions stay ahead in a rapidly evolving regulatory landscape while unlocking new opportunities for credit accessibility.

ScoreEasy simplifies credit decisioning by transforming complex financial data into clear, actionable insights. The platform automates risk assessment, ensuring fair, accurate, and bias-mitigated credit scoring, making lending more inclusive and efficient. With an intuitive dashboard, API-ready integration, and real-time analytics, ScoreEasy streamlines financial operations—reducing processing time, improving loan approvals, and minimizing default risks. Built with compliance and transparency in mind, it helps financial institutions stay ahead in a rapidly evolving regulatory landscape while unlocking new opportunities for credit accessibility.

Category

May 15, 2024

Fintech AI / Credit Risk & Lending Solutions

Fintech AI / Credit Risk & Lending Solutions

Services

May 15, 2024

AI Product Development, Predictive Analytics, Risk Intelligence

AI Product Development, Predictive Analytics, Risk Intelligence

Client

May 15, 2024

Banks, Fintech Companies, Lending Platforms

Banks, Fintech Companies, Lending Platforms

Year

May 15, 2024

2023

2023

ScoreEasy is an AI-driven credit scoring and risk assessment platform designed to empower banks, fintech companies, and lending institutions with data-driven decision-making. By leveraging advanced machine learning models, ScoreEasy automates credit risk evaluation, enhances fraud detection, and ensures faster, more reliable lending processes—helping financial institutions scale with confidence